lakewood co sales tax return form

License file and pay returns for your business. DR 0100 - 2022 Retail Sales Tax Return Supplemental Instructions DR 0103 - 2022 State Service Fee Worksheet.

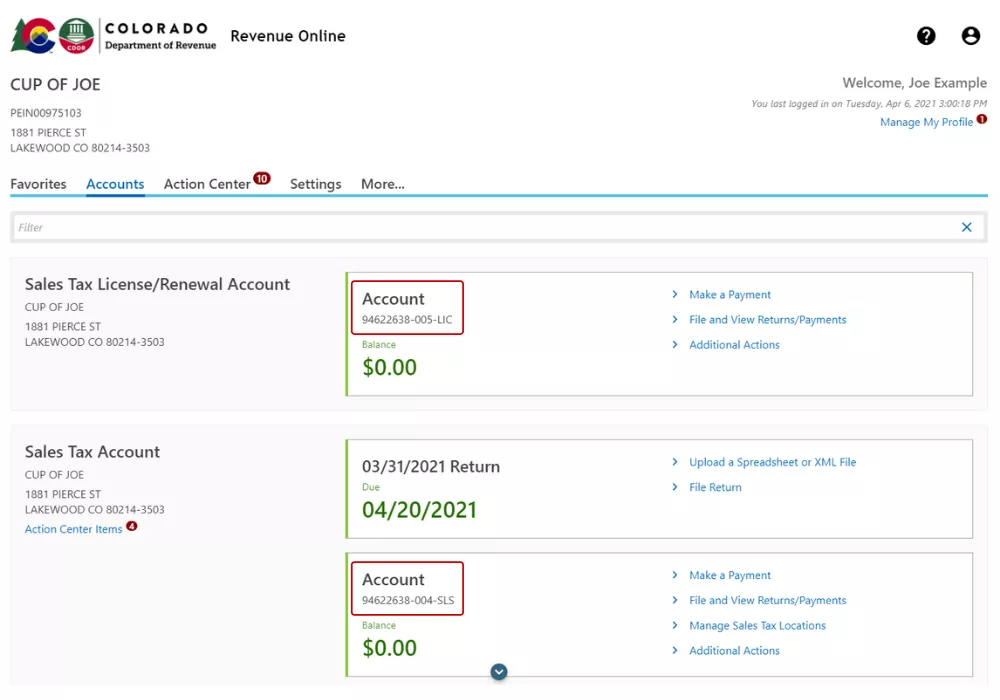

How To Look Up A Colorado Account Number Can Department Of Revenue Taxation

DR 0098 100719 COLORADO DEPARTMENT OF REVENUE Denver CO 80261-0013 ColoradogovTax DONOTSEND Form Instructions In preparing a special event sales tax.

. Return forms will not be mailed out by the City. The PIF is a fee and NOT a tax. Joint Allocation Form.

Sales Tax Rates With the exception of the Belmar Business area the sales tax for Lakewood is 3. What is the sales tax rate in Lakewood Colorado. City salesuse tax return.

CO Sales Tax Rate. File Sales Tax Online. 2022 Sales Tax Application.

The December 2020 total local sales tax rate was also 7500. 15 or less per month. 2022 Sales Tax Due Dates.

The ST3 sales and use tax rate of 050 is effective April 1 2017 bringing the total sales and use tax rate for Sound Transit to 140. Annual returns are due January 20. Returns can be accessed online through Lakewood Business Pro with an established user account.

Lakewood Economic Development makes sure your start-up existing or expanding business benefits from the Citys collaboration and support. Therefore it becomes a part of the overall cost of the saleservice and is subject to sales tax. This is the total of state county and city sales tax rates.

Learn more about transactions. Building Use Tax Refund Application. The Belmar Business areas tax rate is 1.

CR 0100 - Sales Tax and Withholding Account Application. The minimum combined 2022 sales tax rate for Lakewood Colorado is. Learn more about sales and use tax public improvement fees and find resources and publications.

There are a few ways to e-file sales tax returns. 2022 Sales Tax Returns. The current total local sales tax rate in Lakewood CO is 7500.

Declaration of Estimated Tax. Learn more about sales and use tax. Note that in some retail areas of the City a.

Standard Tax Exempt Form. DR 0154 - Sales Tax. How to use the Standard Tax Exempt Form for non-profits and exempt organizations YouTube 2022 Forms.

2021 Sales Tax Returns. Examples of these improvements include curbs and sidewalks. 2021 Sales Tax Application.

Lakewood Village imposes a 150 sales and use tax and. After you create your own User ID and Password for the income tax account you may file a return. Individual Income Tax Registration.

Amount of city sales tax 3 of amount on line 5 00 3 6 7 Non-taxable PIF 00 00 00 00 00 00 2 PIF Deductions 00 4 Taxable PIF from Schedule B line 8 SCHEDULE B - PUBLIC IMPROVEMENT. The City of Lakewood receives 1 of the. Sales tax returns may be filed annually.

Texas imposes a 625 state sales and use tax on all retail sales leases and rentals of most goods as well as taxable services. Filing frequency is determined by the amount of sales tax collected monthly.

Taxvalet Sales Tax Done For You Facebook

City Of Delta Colorado Sales Use Tax Return Form Download Printable Pdf Templateroller

Colorado Sales Tax Colorado Business Resource Book

Wayfair Sues Lakewood Colorado Over Home Rule Sales Tax Complexity Taxvalet

Online Library Taxes Jefferson County Public Library

Form Dr 0800 Fillable Location Jurisdiction Codes For Sales Tax Filing

/https://s3.amazonaws.com/lmbucket0/media/business/colorado-mills-3-1GSQ-1-lYa5BGIO0cuBtm3VRCwUfuDVtlA3YI05_wcULJ1drdI.301e90331d81.jpg)

T Mobile Colorado Mills Mall Lakewood Co

18 Best Lakewood Accountants Expertise Com

Visit A Taxpayer Service Center Department Of Revenue Taxation

Colorado Springs Sales Tax Fill Online Printable Fillable Blank Pdffiller

1908 Paper Ad Lakewood Imperial Caldwell Horse Power Wedgeway Chelsea Lawn Mower Ebay

Dlfmt Registration 2022 Gum Pop Presents

/https://s3.amazonaws.com/lmbucket0/media/business/w-alameda-w-center-ave-275E-1-mYJ_4VpOXzVj4IghzDEIaNFaOoMwKD6YIfghSTDdSkE.a3714e1e930d.jpg)

T Mobile W Alameda W Center Ave Lakewood Co

New 2023 Lexus In Lakewood Co Stevinson Lexus Of Lakewood

Taxes And Fees In Lakewood City Of Lakewood

City Of Lakewood Income Tax Fill Online Printable Fillable Blank Pdffiller